At last, your MVP is finished and you can finally release it for the world to try. But what should you charge for it? This is the million-dollar question (sometimes literally) that you need to answer by choosing and exercising a product pricing strategy.

Straight ahead, a selection of different pricing strategies await you—along with their best use cases. If you're stressed about deterring users or possibly leaving money on the table, keep reading!

A Crash Course on the Economics Of Prices

Before we speak about any pricing strategy, let’s refresh your memory on the basics of economics (and maybe even get you nostalgic about your business school days).

The price that you have set for your products is one of the key factors determining the success of your overall business endeavor, as the way you handle prices will:

Determine the demand for your product. Products with cheaper prices tend to attract more consumer demand while expensive products appeal to a narrower audience. But it's worth noting that, while this is the general rule, there are lots of exceptions.

There is a reason I chose the words “tend to.” Humans are not rational creatures (tough luck, Adam Smith). They will not always try to go for the best value for their money and the premium pricing strategy that we will soon discuss together relies on this.

Directly affect your bottom line. This part is straightforward: the higher your prices, the more profit you earn from the sales of your product.

In reality, the relationship between the level of your prices and your profits is not that straightforward or linear.

Instead of a direct line like this:

You will most likely have a bell-shaped curve like this:

The reason behind this shape is the declining market demand for your product. If you have priced it too high, there will be fewer customers who will be ready to buy your products and you can even go past the break-even point and start losing money.

Therefore, your goal would be to determine your break-even points (both the lowest profitable price and the highest one) to know which prices you should avoid, as well as find the ideal price of a product that will earn you the most profit.

This statement was from a purely economic point of view. Depending on your goals, vision, and business strategy, you might choose not to strive for the best pricing with the highest profits. Instead, you might consider hitting your competitors with lower prices to take over their market share or charge more than everyone else to position yourself as a “luxury” product.

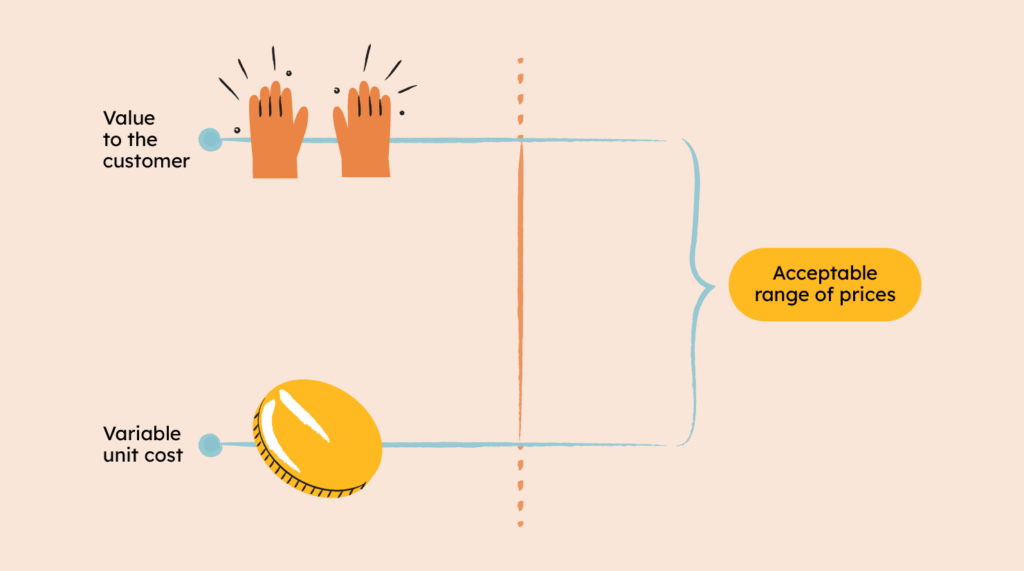

No matter how you decide to approach your pricing strategy, you will have to set your prices within a certain range where the benchmark for the upper limit is your customers’ willingness to pay and the lower limit is your product’s unit cost.

Now let’s discuss these two concepts in more detail.

What is Customer Willingness to Pay and How Can You Measure It?

I first encountered this concept when I was studying competitive strategy using Michael Porter’s “5 Forces” framework. (I highly recommend that you check it out, too.)

One of these five forces is the buyer’s bargaining power, which is their ability to force your prices down. A strong factor that determines this ability is their willingness to pay (WTP) as a higher WTP means that buyers have less power to lower your prices.

The customer willingness to pay is the maximum price that your target market will pay to obtain your product. Yes, there will be cases when your customers are ready to pay more than their WTP, but you can expect to lose the vast majority of your customer base if you start charging a price above the WTP.

It is important to note that the willingness to pay for a certain product can vary among different cohorts of customers based on a wide range of characteristics, including:

- Demographics: Older people are more willing to pay for a luxury hotel room with comfortable amenities than teenagers or students who are ready to stay at hostels with shared rooms to save money.

- Geographic location: People in western countries are more willing to pay for music streaming than their counterparts in post-Soviet countries. Hence, the subscription for Apple Music is $10/month in the U.S. while Yandex Music will charge $2/month for a similar streaming service in Armenia.

- Drive for obtaining social status: Sometimes products serve as tools for increasing the social status of their users. While a smartwatch might be a basic utility for some people and they would never pay $400 for the base-model Apple Watch, others might see it as a status symbol and would be willing to pay $1,000 or more to get the luxury edition with leather and gold plating.

- Urgency: If you are walking around the Eiffel Tower in Paris and it starts to rain, a group of highly-entrepreneurial residents will quickly approach you and offer to sell a low-quality umbrella for €20. Maybe you would never pay €20 for a crappy umbrella in a shop, but your priorities might change when it’s raining and you're about to get drenched.

There are many other factors affecting someone’s willingness to pay that we won't cover in this article. Let's move on and learn the ways you can measure your product’s WTP.

Among the multitude of tactics to measure WTP, these three are the most effective:

- Customer interviews: Let customers experience the core value of your product, then simply ask about the maximum price that they would be willing to pay for it.

- Experiments and A/B tests: You can offer your product at different price points to your target audience and compare the number of purchases that each price point has generated.

- Auctions: Try selling your products at an auction. People will usually not bid more than what they are willing to pay for the product in question. Therefore, you can consider the highest bid to be your WTP.

This covers the upper limit of our selling price range. Now, let’s move on to understanding what the lowest acceptable price can be for your products.

What is Your Product’s Unit Cost?

You will not be able to make a profit selling your products if the price is less than their unit cost.

Unit Cost is the sum of all expenses that you need to incur to produce a single unit of your product. It consists of two components—fixed costs and variable costs.

Fixed Costs will remain the same and not depend on the number of products you create. Typical examples of fixed production costs are the salaries of most of your staff as well as the fees you pay for your domain name or SSL certificate.

Variable Costs will change proportionally to the number of products you make. For software and especially SaaS, your infrastructure and hosting fees are the most prominent variable cost as increasing the number of users will increase your usage of processing power on the cloud.

To calculate the unit cost of your product, you can use this formula:

The formula above is a generic one that also applies to physical products. For software and SaaS, you will divide your total costs by the number of users.

To sum up, setting prices for your products that are either above your customers’ WTP or below your unit costs will result in quick losses and negative cash flow. While it is a great idea to try out many pricing methods and experiment with different price points, it is financially a good idea to stay within these two limits.

With “Pricing Economics 101” behind us, let us begin listing some of the most common pricing strategies and try to make sense of them.

5 Popular Pricing Strategies: Pros, Cons, and Examples

Humans have sold goods and services since the dawn of time. Therefore, there are lots of well-tested strategies for setting prices on your products.

The list that I have compiled for you below includes the strategies that I have found to be the most effective among the many out there.

Strategy #1: Penetration Pricing

Penetration Pricing is a strategy of purposefully setting low prices for your products in order to stand out in the crowd of competitors and rapidly grow your customer base.

This strategy might seem counterintuitive at first glance. Why do you need lots of customers if you will be earning little money from them? The answer is simple—penetration pricing is not about earning profits, it is usually serving more strategic goals, like gaining brand recognition or democratizing a technology.

To understand this strategy a bit better, let’s go over the pros and cons that you might encounter when using it on your products.

Advantages and Disadvantages of Penetration Pricing

Selling your products at a low price point will definitely be risky from a financial standpoint. But this is not the only potential downside of this strategy, as penetration pricing is also:

Hard to maintain in the long run. This strategy will burn a lot of money and hurt your cash flow. Not all businesses are able to survive several years under such financial pressure. Therefore, you should either avoid using penetration pricing as a long-term strategy or diversify and stay afloat using alternative sources of income.

Setting an expectation of low prices. Once you have gathered a customer base by attracting them to your side with low prices, they will have an expectation that you will keep the prices at the same level in the future, and raising your prices might upset them.

Low loyalty of your customer base. The chances are quite high that the people you onboard as customers with this strategy are the ones who are sensitive to price changes as price-insensitive customers would not change their current vendor for a cheaper product.

One of the caveats of this group is that they will leave you as easily as they have left their previous vendor if there is another product with even lower prices in the market.

Building a large customer base early on comes with many significant advantages, including:

Economies of scale. As you increase your operational capacity, you will gain significant bargaining power over your vendors and negotiate better deals with them. Moreover, you will also be able to disperse your fixed costs over a larger number of products and significantly decrease your unit costs.

Establishing your brand and solidifying your spot in the market. Having a large customer base will also help you become a prominent actor in the market, get a solid grasp on your piece of the pie, and make it hard to compete with you.

Judging from the pros and cons of this strategy, we can say that it is not meant for every product out there—but there are specific cases when penetration pricing is worth a try.

When Is Penetration Pricing the Best Choice?

As this strategy is about gaining market share with the promise of low prices, the first thing that you need to pay attention to is the price elasticity of the market.

There is strong elasticity in the market if a change in prices leads to a significant change in demand. Here’s what elastic and inelastic markets look like.

People in elastic markets are more price-sensitive and will happily leave your competitors and join your customer base if you promise them lower prices. If the market is inelastic, though, it will be much harder for you to sway potential customers to your side as they will not care for cheaper prices.

To get a better grasp of this concept, let’s look at a couple of examples of elastic and inelastic markets.

Elastic markets:

- Cloud infrastructure. You will happily jump to the cheaper provider if they meet your requirements.

- Productivity tools. Maybe there's no real difference between a Miro board and a Figjam board for your particular usage habits, so you might easily substitute one for another.

Inelastic markets:

- Domain names for your company and products. You will keep paying the fee even if there are price increases.

- Financial and accounting services for your company. Believe me, you don’t want to save on this.

Based on the examples above, it's a much better idea to use penetration pricing if you're a cloud services provider than if you were selling domain names.

Apart from avoiding inelastic markets for this pricing strategy, you should also clearly understand that penetration pricing is not meant to earn you significant profits and you should use it only when you have a larger strategic goal in mind.

Some of the common strategic goals that penetration pricing can contribute to include:

Employing the network effect to grow. If your market is susceptible to the network effect (when the user value increases with the number of users on the platform), then penetration pricing is a great tool to give you a head start. A typical example of a market with a network effect is social media.

Creating a base that you can monetize with alternative methods. Sometimes businesses will lose money on selling you their platform just to hook you to their ecosystem and earn money from secondary products. Amazon Kindle is one of these products, as the company earns money off the books you buy and read on it.

With the concept of penetration pricing clear, let us look at a couple of real-life examples of companies successfully using it.

Example of Penetration Pricing

As mentioned earlier, penetration pricing usually serves a specific strategic goal.

Xiaomi, the company that I want to talk about today, has a strategy of establishing its brand and solidifying its position in a highly competitive market of smartphones.

To reach its goal, Xiaomi started producing top-tier smartphones and selling them for the fraction of its competitors’ prices. Its first major product was Mi 1 that you could buy for ~$300.

By offering a flagship model at the price of a budget phone, Xiaomi started rapidly gaining in popularity.

The penetration pricing strategy of Xiaomi was a massive success as it soon became one of the top producers of smartphones in the world with a market share of around 14% in 2021.

Strategy #2: Price Skimming

In terms of the approach taken, Price Skimming is the opposite of Penetration Pricing. Unlike its predecessor, this strategy involves starting with a high price and lowering it over time as the product matures.

The main logic behind price skimming is to target different audiences during different phases of the product lifecycle. In the beginning, when you are you are selling something novel and new, the mainstream market will not buy it yet as they are not familiar with your technology/product.

Therefore, you start targeting enthusiasts and early adopters who are usually not price-sensitive and will happily buy innovative products for high prices. Then, as soon as your product becomes mainstream, you start lowering your prices to be able to target the mainstream market where the consumers are much more price-sensitive.

This tactic seems quite clever and we can instantly think of multiple reasons to adopt it. However, it comes with caveats too. Let’s go over both the pros and cons of price skimming to understand it better.

Advantages and Disadvantages of Price Skimming

Selling your products at high price points, in the beginning, can be a great idea because:

- You get early money: The revenue that you earn from your early adopters will help you offset some of the research and development costs for your new product, as well as be a good indicator that you are nearing a product-market fit.

- You target the most lucrative market first: Early adopters are the perfect customers for any product. They are ready to buy your product at a high price, tolerate your bugs and imperfections, as well as actively provide you with valuable user feedback.

- The challenge of selling something novel: When you are introducing an innovative technology or product to the market, it will not always be easy to convince your first customers that it is something valuable and worth the high price that you have set on it.

- Getting copycats in late stages: As soon as your product matures and the mass market starts adopting it, you will start competing with copycat products that will want to secure their own piece of the pie with low prices as their main competitive advantage.

But, upon adopting price skimming as your strategy of choice, you will soon find out about some of its disadvantages, such as:

- Limited market penetration: By setting a high initial price, the product may be out of reach for some potential customers, limiting your product's market penetration. This can be a big problem in already saturated markets.

- Potential for negative perceptions: If customers perceive the initial high price as unfair or unreasonable, it can damage your brand's image and reputation.

- Difficulty in maintaining high prices: High prices attract competitors like sharks drawn to a drop of blood. Competitors may enter the market with lower-priced alternatives, or the market demand may shift, making it difficult to maintain high prices over time.

- Limited revenue potential: While the initial high price may generate significant revenue in the short term, it may limit the product's overall revenue potential if you're not able to keep the price optimized for your customer's WTP.

- Negative impact on sales volume: High initial prices may result in slower sales volume, which could lead to reduced revenue and a longer time to break even on development and marketing costs.

With a clear overview of the pros and cons of price skimming, we can move on to understanding the best use cases for adopting this strategy.

When Is Price Skimming the Best Choice?

You may have noticed that I kept mentioning innovative products and technologies when talking about this pricing strategy.

This is because price skimming will quickly fail for established technologies and markets where you have competitors offering the same product for lower prices. In a new market, on the other hand, you are the only player (or one of the very few) and you can afford to set a high price on your products without the fear of getting into price wars with others.

This strategy is quite popular among startups who try to disrupt the market with something that nobody else has done before. Let’s look at one of these startups and see how they have used price skimming.

Example of Price Skimming

Tesla Motors has probably been the most “buzzed about” brand and product out there for the last couple of years. This is because Elon Musk’s electric cars are sleek, quick, and exceptionally innovative.

Tesla cars were so successful that they have shifted the entire auto industry into ditching internal combustion engines and going electric. But before reaching market adoption, Tesla cars were something very niche that only enthusiasts would buy.

Elon Musk’s adopted the price-skimming strategy with Teslas when the company started selling the original roadster for $130,000.

He used the funds gathered from selling the roadster to early electric car enthusiasts to develop its second major product - the Model S which had a price tag of $57,400.

Unlike its predecessor, the Model S was targeting a wider audience of early mainstream customers with a much lower price.

Tesla’s final product serving this strategy was the Model 3 that you can get for $35,000. By producing a relatively-cheap electric car, Tesla was able to target the entire car market and successfully reach market adoption for the electric car.

Strategy #3: Value-based Pricing and Premium Pricing

This strategy is what many SaaS products are trying to adopt. Value-based pricing means that you are setting the prices at a level that is comparable to the value that your customers are getting from you.

For instance, if you are able to save 1 hour of work per day for each employee of a 1,000-person company with an hourly salary of $50, then you are creating $50,000 a day in value. It means that even if you price your product slightly lower than $50k, you are still saving the company money and it makes sense for them to pay the price.

This example was a bit simplified to help you get the idea. In real life, it is much harder to represent your customers’ perception of a product’s value in dollars. Therefore, companies will use tactics such as:

- Looking at the amount that customers pay for alternative solutions. (For example, language teaching apps using language tutor prices as a baseline.)

- Experimenting with different price points to see which one performs the best.

- Doing market research and directly asking new customers how much they would be ready to pay for their solution.

Some economics experts also love to use the term Premium Pricing for this model, as your approach is about increasing the perceived value of your product instead of decreasing your prices—sometimes you can just keep increasing them!

Advantages and Disadvantages of Value-based Pricing

From a business standpoint, value-based pricing seems like the best option as you are naturally trying to get the most profit out of your products. However, just like any other strategy on our list, it has both pros and cons.

Apart from high-profit margins, other advantages of value-based pricing include:

- High customer satisfaction: No matter what your seling price is, your customers think that they are getting more value than what they are paying for.

- High loyalty: The perception of getting value also means that your customers are less likely to leave you for a cheaper product.

- Ability to increase prices: If you add new features and provide additional value to your customers, you can easily increase your prices without losing customers.

But there are downsides to value-based pricing. Consider the following:

- Your product needs to have strong differentiation: Otherwise, you will provide the same value as your competitors and will have to start decreasing prices.

- Creating value is hard: It is much easier to become a copycat of another product and compete with prices than to create significant value for your customers.

So, considering its pros and cons, when is it best to use value-based pricing?

When Is Value-based Pricing the Best Choice?

Value-based pricing is the optimal choice for your product if:

It is relatively easy to differentiate yourself from the competition. By producing water near the Rocky Mountains, you automatically get a “crystal fresh water from the Rockies” differentiator and stand out in the market.

You are targeting the upper/premium market. Consumers of high-end products are not price sensitive and make buying decisions based on perceived value. Even if there are other alternatives offering lower prices, this segment will ignore them as the value they provide is inferior to your product.

Example of Value-based Pricing

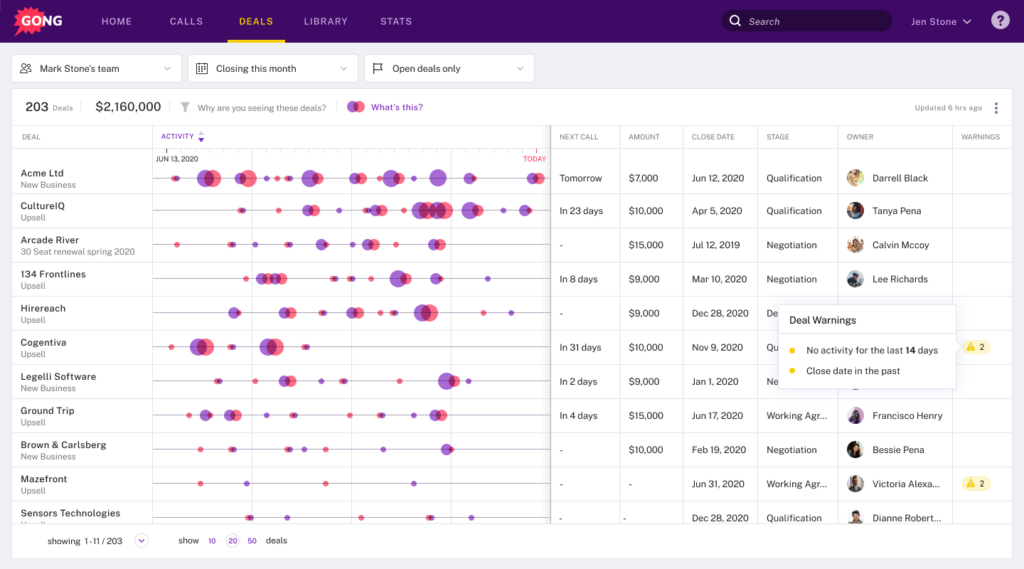

As mentioned, value-based pricing is quite popular in the software industry. Let’s look at Gong.io as a prominent example of a product that has successfully used this strategy.

Gong.io is specialized in improving the efficiency and effectiveness of your sales team’s operations. It comes with a variety of tools that cover nearly all aspects of the sales process, including prospecting, video call analysis and intelligence, forecasting, and more.

Unlike many SaaS products out there, Gong does not publicize its price list on its website. You will have to fill in your contact details for a Gong representative to contact you and negotiate a custom price for your specific case.

The reason behind the sales rep giving you a price quote instead of Gong publicizing it? It’s an expensive product. According to some sources, Gong can cost somewhere near $3,000 per month for a team of 20.

Gong is able to charge this amount from its users because it provides far more value than the price tag they have put on its platform. In the hands of a skilled sales team, Gong can help you increase sales volume a lot more than the money you pay for it.

Strategy #4: Dynamic Pricing

Product prices should never be carved in stone. Great product and growth teams constantly experiment with different price points and pricing strategies to find the sweet spot and keep up with the competition.

While experimenting with prices is a great idea, you can go one step further and change the prices you show to your users dynamically depending on various factors such as their:

- Location and Language: e.g. Western European users see a $20/month on your Pricing page, while post-Soviet countries see $16/month.

- Past interest in the product: For example, if you have searched for flights from London to Paris 5 times during the past week, it means that you will probably still buy those tickets even if the price gets a bit higher.

- Demand for your product at that moment in time: This is very common for ride-sharing services like Uber. If it’s rush hour, you will pay a higher price for a ride than the daily average.

While it sounds like a great idea to maximize your revenue, be careful with this strategy as your pricing policy can quickly become unfair and your customers might perceive you as an unethical business.

Advantages and Disadvantages of Dynamic Pricing

This strategy is relatively new and was made possible by the recent technological boom that allowed businesses to track user activity, analyze their demographic and behavioral data, and find the right price for each user segment.

The heavy reliance of this strategy on tech has resulted in both significant advantages and downsides. Let’s see what they are.

Advantages of dynamic pricing include:

- It gets you the most bang for your buck: The sophisticated algorithms behind dynamic pricing models can find the price points for each segment that will result in the most sales/revenue.

- It helps you stay ahead of the competition: If you incorporate the prices of your competitors into your dynamic pricing algorithms, you will automatically respond to any change that they make in their pricing policies.

But, the downsides of dynamic prices are:

- It is data-intensive: Your dynamic prices will not be effective if you do not have a significant amount of data about your users and their behavior.

- It’s complex: Dynamic pricing algorithms add a significant amount of complexity to your pricing policy and anything complex is hard to manage and maintain.

Finally, to enable dynamic pricing for your products, you will need to physically create and integrate that logic into your product’s codebase.

When Is Dynamic Pricing the Best Choice?

Considering the pros and cons that we have discussed, we can state that dynamic pricing will be your best option if:

You already have lots of customer data: You will not have to spend significant resources on obtaining data (good quality data is super expensive) that you need for your algorithms.

You have the technical capacity to build and maintain it: This means that you can either afford to delegate these tasks to a specialized software company, or you have the engineering capacity in-house to handle the dynamic pricing algorithms.

Examples of Dynamic Pricing

Probably the most famous users of the dynamic pricing model are airlines.

The websites selling tickets will constantly change the prices based on your country/location, whether flying is a necessity for you (e.g. Delta charging $300 extra to frequent flyers assuming that they have to buy the ticket anyways), as well as seasonality.

Both of the flights above are between London and JFK. The only difference between them is the date of the flight. The more expensive one is a weekly trip to New York during Christmas, while the cheaper one is scheduled sometime in May.

Strategy #5: Competitive Pricing

As the name suggests, this strategy is about keeping your prices aligned with your competition.

The classical path that you can take in this case is analyzing the prices of your competitors, averaging them, and offering products cheaper than the average or only the prices of your main competitors.

Although it might sound unusual at first, competitive pricing can also assume setting comparable prices. In this case, as you have a level playing field with the competition, your strategy would be to shine with your differentiating features and abilities.

Advantages and Disadvantages of Competitive Pricing

Interacting with the competition by matching their prices or lowering them can be a dangerous game, as you can end up starting price wars. By artificially lowering your prices just for the sake of hurting your competitor, you can easily hurt yourself too, as unnaturally-low prices will take a significant toll on your bottom line.

This is probably the only significant risk for competitive pricing, as it is a relatively reliable approach to attracting customers to your business and competing with others.

When Is Competitive Pricing the Best Choice?

Competitive pricing is a common strategy that you want to take if you are in a mature market and the product you sell is a commodity. There are no innovative products in this market that users will pay a premium for. Nor do you offer any premium products that will attract customers who prioritize value over price.

Here are a couple of examples of mature and commoditized markets:

- Product management tools (e.g. Monday.com and Wrike).

- Messengers (e.g. WeChat, Telegram, Whatsapp).

- Cloud storage (e.g. Box, Dropbox, Mega).

- Retail stores (e.g. eCommerce, grocery stores,

There's also the hosting service provider market where you can make a lot of headway by lowering your prices by only a couple of dollars.

Examples of Competitive Pricing

Let’s talk about digital marketing tools and all-in-one platforms in particular. If you ask me to name a digital marketing all-in-one, my answer would probably be HubSpot as it is the most popular one out there.

Apart from being popular, HubSpot is also a relatively-expensive tool, with the business version costing somewhere around $3,000/month. Therefore, naturally, HubSpot has gained competitors who are offering similar products for much lower prices. One of these platforms is Engagebay.

Just like HubSpot, this platform is also offering CRM, sales, support, and marketing product lines with minor fluctuations. But, instead of charging $3,000/month, it follows an economy pricing strategy and offers its pro package to small business owners for a much lower cost of $84.99/month with an option to try it in freemium mode.

Bonus: Cost-plus Pricing and Psychological Pricing

Although these five pricing strategies are the main ones for you to consider, I would like to give honorable mentions to two more strategies and explain them with short overviews.

Cost-plus Pricing

If you remember from the pricing crash course in the beginning, there were upper and lower limits for setting your prices. While the upper limit is the territory where you exercise premium pricing, the lower limit is where you do cost-based pricing.

With this strategy, you are calculating the unit cost of your products, then adding a markup over it. For instance, if a single user of an email marketing SaaS costs your infrastructure and the team $10 per month, then you can decide to set a profit margin of 20% and charge your customer $12 per month for your tool.

Psychological Pricing

This is not a competitive pricing strategy per se. It’s rather a set of tactics and psychological tricks that you can use when setting your prices.

One of the most common tactics is the power of “.99” when people perceive $9.99 to be cheaper than $10.

Another common trick is to create a sense of urgency (a.k.a. FOMO or Fear of Missing Out) by offering special bonuses for a limited time period.

To Sum Up

The proper management of your pricing policy will make or break your business. Luckily, there are lots of well-tried strategies covering every possible use case that you can use to make sure that you are getting the most profit and strategic value out of your products.

If you already have an idea of how to manage your prices, you can move on to exploring other aspects of building great products, such as:

Apart from these compelling guides, you can also receive lots of valuable content on everything product management by subscribing to our newsletter.