The software world is experiencing significant turmoil with the recession, tech layovers, and the significant drop in VC investments.

If you are reading this article, I'm assuming the latter is what concerns you most, as you may be in the process of raising funds for your product.

The good news is that things are not as horrible as they look on paper. VCs have not stopped investing—they have simply changed their priorities and how they evaluate startups.

To address this new reality, this article will kick off a four-part series we're calling The Next Round, in which we will look at the process of raising VC capital with a focus on the post-pandemic reality and investor priorities.

Let's begin by examining what has changed in the VC world in the wake of the crisis.

What’s Going On in the Venture Capital Market?

Before we begin looking at the changes in VC priorities when it comes to funding startups, let’s take stock of what's occurring in the venture capital market in 2023.

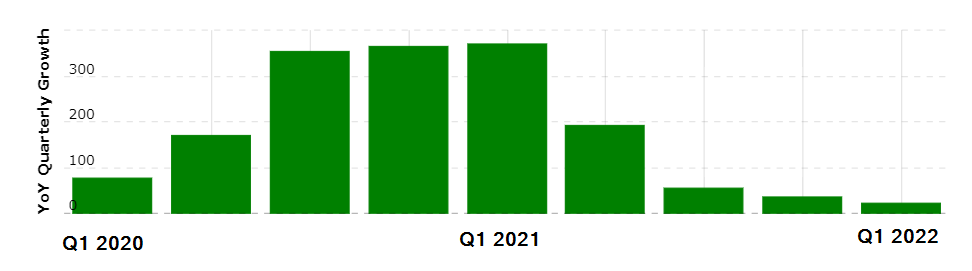

To say that COVID-19 had a big impact on business would be a massive understatement. Lockdowns and sudden shifts to working from home resulted in a surge in demand for digital products. Just look at the quarterly growth rate of Zoom throughout the pandemic.

This same chart also shows something else—the sudden drop in the growth rate as soon as the pandemic was over. There were two major factors contributing to this drop:

Remote work did not become the norm

One of the big surprises for everyone (both business leaders and employees) was that remote work actually went really well during the lockdowns. There was no significant drop in productivity, employees enjoyed spending the newfound time with their families, and some businesses even realized that they did not have to pay office rent anymore as there was no need for a physical office.

Thanks to this, VCs thought that remote work would stay after the pandemic as well, and the surge in demand for digital products would be much higher than in pre-COVID-19 times. They were mostly right—however, the number of companies returning to an “in-office” or hybrid work style was much higher than expected, resulting in lower demand than anticipated.

We ended up with a recession, a stock market crash, and a cost-of-living crisis

Although world governments did their best to protect citizens and businesses from the economic consequences of lockdowns and other safety measures (e.g. travel bans and restricted customs control), a recession was inevitable.

The result of this crisis was less disposable income in the hands of ordinary citizens, which led to lower spending, which led to drops in revenue for businesses.

Therefore, there was much less money to spend on digital products—leading to a significant drop in growth rates and shorter runways for startups burning VC money.

How did VCs respond to the drop in startup growth and revenue?

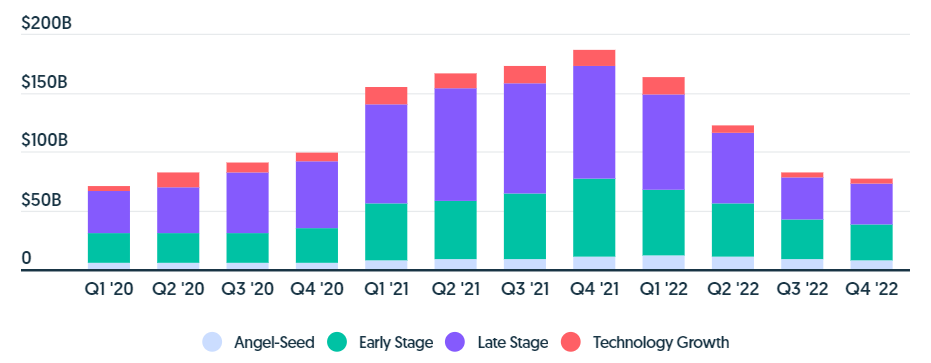

When the pandemic was in full swing, and the entire planet was working from home, the VC world started aggressively investing in digital products and into the general notion of remote work. Here's what the investment volumes looked like throughout the pandemic.

But, as we can see from the chart, the drop in startup growth and revenue, and the COVID-19 crisis in general, resulted in a steep drop in venture capital activity as well.

The reason is that we ended up in this vicious cycle:

- A drop in the growth rate for startups made it difficult to attract new investment. Layer in the drop in revenue from the recession, and you end up with hundreds of startups running out of money and into the ground.

- The increased failure rate of startups forces VC firms to think twice before investing. Moreover, to compensate for the increased risk, VCs make the capital pricier by offering less money for a larger share of equity at a lower valuation rate.

- This makes it even harder for startups to attract capital—making them more likely to fail.

The good news is that investors are still willing and happy to get you the capital you need to grow your startup. However, the way they approach startup evaluation and the aspects that they pay attention to have changed.

How Has Investor Sentiment Changed in 2023?

Before digging deeper into this topic, my impression was that the VC world had simply become more risk-averse when making investment decisions.

I discussed this matter with a couple of investors, as well as company founders who are planning to attract more VC funding (including the founders of the product I am leading now).

What I learned was that things are not so simple, and it's not always about investing in "less risky" startups.

Instead, there is a general change in what the VCs are paying attention to when deciding to invest in a startup.

Here's what’s important to investors today.

How “real” is the problem you're solving?

Do you remember Juicero? It was a $400 juice machine that required you to buy pre-packaged juices that it would simply squeeze out of the package into your glass.

Well, the founders ended up raising a whopping $120 million in the mid-2010s for their mechanical whatever-this-is (I refuse to call it a product).

How on Earth?! In short, the 2010s was an era when you could pitch just about anything to investors and get funding. Things got a little less weird by the end of the decade, but the notion of "products with weak problem-solution fit still getting investment" was still there.

The post-pandemic recession and stock market volatility, however, made it clear that this was not a sustainable approach for VCs.

Today, you will need to prove that the problem you claim your target market is experiencing is real, and painful enough that a quantifiable amount of users are looking for a paid solution.

So, if you pitched Juicero today, you would most definitely get a rejection letter from the investors as it was not a product that was solving anything.

Is your business model viable and profitable?

Before the fallout from COVID-19 started taking its toll on the economy, the VC requirements for the sturdiness of the business plan were not that strict. In fact, there were numerous startups with questionable business models that ended up receiving significant funding during the—you guessed it!—mid-2010s.

One particular case that I want to mention is MoviePass—a subscription-based service that let users watch movies at local theatres for a monthly fee. What they wanted to create was essentially Spotify for movie theaters. The idea was actually pretty good, and they ended up raising north of $70 million.

The business model, however, was highly unsustainable.

The problem was that MoviePass had to buy tickets from theaters at full price, then bundle and sell them to the users at a significant discount—leading them to operate at a loss. Their idea was that once they had enough users, they would be able to negotiate significant discounts for the movie tickets they were buying.

The theaters, however, refused to provide these discounts, as their calculations showed that they would earn less money this way.

This led to MoviePass burning all of its investor money and meeting an untimely end.

Are you growing sustainably?

I am a big fan of the Growth Series by Reforge, as it has helped me shape the mindset of building sustainable growth engines. The reason folks at Reforge focus on teaching sustainable growth is that the startup market has been failing at it miserably over the past decade.

Increasing the number of users (even paid ones) does not necessarily mean that you are doing a great job as a business (more on this later). But this is, again, something that the VC world was not prioritizing in the past.

What they wanted was explosive growth. To meet these expectations, startups started neglecting the long-term sustainability of the users they were acquiring and focused their efforts on the number of signups instead.

A well-known example of this is the dearly-departed Vine. This TikTok predecessor appeared to be a massive success at first—it had explosive growth and managed to acquire hundreds of millions of users. The problem with Vine, however (and something that TikTok did well later on) was that they had focused too much on simply adding signups without caring much about the experience that these users were getting inside the app.

In particular, Vine could not give proper monetary incentives to content creators. This resulted in the creator community migrating to other platforms where they could earn more money from their content.

With worse content, Vine users started churning—resulting in the app's ultimate failure.

Are you "shock-resistant?"

This is probably one of the few instances where being compared with a cockroach should be taken as a compliment. Investor attention has shifted toward startups that can prove their ability to withstand various types of crises, including the one we are experiencing now.

Here is how a seasoned investor explained it to me:

We always gave priority to startups that could survive hard times. However, we did not expect these hard times to be as severe as the recession we are witnessing now.

The current situation has made us review our requirements for resilience and consider investing in those startups that are able to demonstrate their ability to stay afloat, no matter the economic situation.

Rem Darbinyan

Angel Investor, Advisory Board Member at Formula VC

One of the prominent examples of promising startups that lacked resilience and failed during the pandemic was the interior design application Modsy. The lockdown and the subsequent cost of living crisis led to people deprioritizing their home improvement projects—leading to a significant drop in Modsy’s revenue.

The company ended up spending all of its $60 million investment funds by mid-2022 and didn't make it to 2023.

An Action Plan for Post-Pandemic Startups

Armed with a bit more insight into the current priorities of investors, you might be asking yourself if you need to change the way you manage and grow your product to meet these standards.

The answer will, of course, depend on whether your startup exudes cockroach vibes—as in, how shock-resistant is the business? However, I do have two tips that you can take into consideration regardless of where your product stands in terms of these requirements.

Focus on sturdy, sustainable growth

There is a reason I use the term "sustainable" all over the place in this article—this is the main area where you should focus your attention.

In terms of growth, you should not use your main growth metric (MAU or WAU) in isolation. Instead, you should pair it with another metric that can show the level of long-term customer satisfaction with your product.

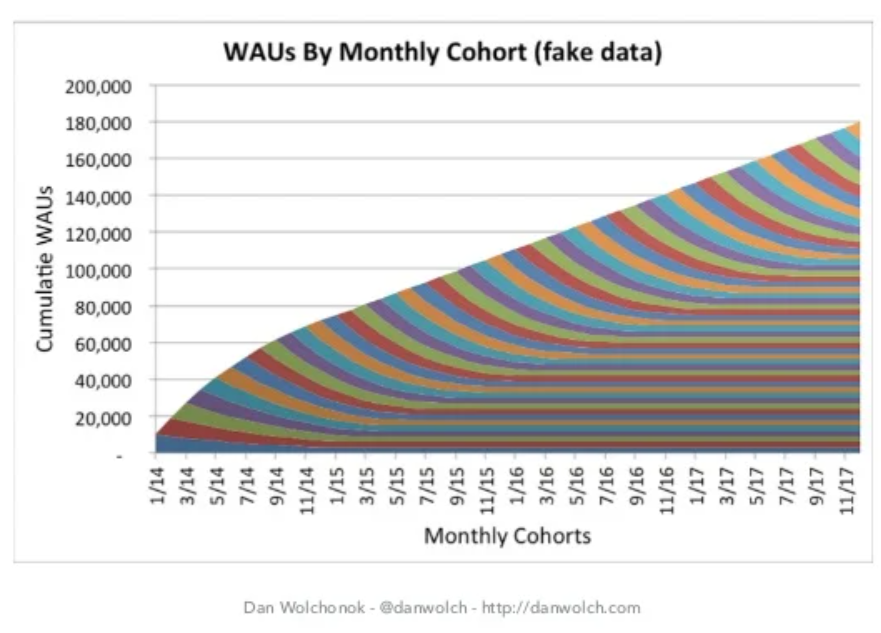

Usually, it's your retention. The better the retention, the more people decide to use your product in the long run. To understand the magnitude of impact that retention can have on your growth, look at this chart:

Here, we have a product that is growing pretty fast. However, the retention curve for it is not flat. It means that 100% of users eventually churn, and you need to rely on new acquisitions to keep your usage growing.

The problem with bad retention is that you will end up reaching a point when you are losing as many users as you acquire (as evidenced in the chart above). If you continue operating like this, you will experience something called a “shark fin” chart—evidence that you're losing active users.

With healthy retention, on the other hand, the chart looks much more promising:

In the chart above, the growth rate is actually slower compared to the one with bad retention. However, because the retention is flat here, there's a cumulative effect as newly-acquired users gradually join the bunch that you have been successfully retaining.

This is exactly why it pays to invest time and effort into user onboarding. A great onboarding experience leads to higher rates of product adoption, which leads to higher retention. This gives you some insurance that, even when you face difficulties and your growth rate slows down, you will not lose your user base, as the bulk of your users are likely to stick around long-term.

Focus on building a viable business model

This is a complex topic, so I recommend starting with a primer on validating startup ideas, finding your PMF, and avoiding shiny object syndrome.

The logic here is that your focus as a startup should not be on growing mindlessly. Actually, growth should be the result of a good problem-solution fit when you are able to solve a real problem with a sustainable business model.

Therefore, your main focus should be to test a wide variety of hypotheses that you have based on your business model on, validate them, and pivot if needed.

The Recession Will End Soon

I’m no economist, so I lack the knowledge and skills to tell you when exactly the recession will end. But I do know that the world economy constantly goes through periods of recession and growth. That means good times are ahead of us—hopefully sooner than we think.

Read the Other Articles in the Series

In Part Two of The Next Round, we get granular on how to create and demonstrate your business model, market traction, and financial forecasts in your pitch deck.

Part Three dives into calculating your market valuation and negotiating equity with investors.

Part Four is all about how to pass due diligence and move on to the next stage of your business's lifecycle.

Finally, make sure to keep up with even more product management insights and guides by signing up for our awesome newsletter.